Introduction

In recent years, there has been a growing interest in eco-friendly cars as individuals and businesses aim to reduce their carbon footprint and contribute to a sustainable future. One of the key incentives for purchasing and owning eco-friendly cars is the availability of tax benefits. This article explores the various tax benefits that eco-friendly car owners can take advantage of and the impact these benefits have on promoting the adoption of environmentally friendly vehicles.

Historical Background

The development of eco-friendly cars and the emergence of tax benefits are closely linked. Advancements in technology and growing concerns about climate change have led to the creation of more efficient and environmentally friendly vehicles. In response, governments worldwide have introduced tax benefits to incentivize the purchase and use of eco-friendly cars.

Key Concepts and Definitions

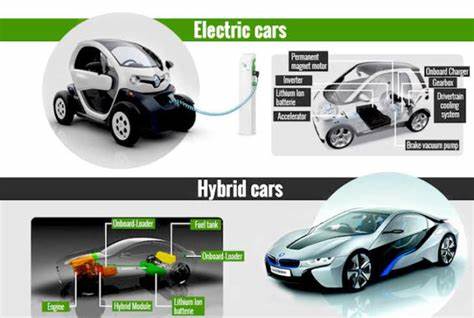

To understand the tax benefits available to eco-friendly car owners, it is essential to define what constitutes an eco-friendly car. Generally, eco-friendly cars are vehicles that produce lower emissions of greenhouse gases and have higher fuel efficiency compared to traditional gasoline-powered cars. Tax benefits, in this context, refer to financial incentives provided by governments to encourage the adoption of eco-friendly cars through tax credits, deductions, exemptions, or rebates.

Main Discussion Points

Types of Tax Benefits for Eco-Friendly Car Owners

Federal Tax Incentives: The federal government offers various tax incentives to eco-friendly car owners. These incentives include tax credits for purchasing electric vehicles or plug-in hybrid vehicles.

State and Local Tax Incentives: In addition to federal tax incentives, many states and local governments provide their own tax benefits for eco-friendly car owners. These benefits may include tax exemptions, rebates, or reduced registration fees.

Tax Credits vs. Tax Deductions: It is important to differentiate between tax credits and tax deductions. Tax credits directly reduce the amount of tax owed, while tax deductions reduce the taxable income. Both types of benefits can provide significant savings for eco-friendly car owners.

Specific Tax Benefits Available to Eco-Friendly Car Owners

Federal Tax Credits for Electric Vehicles: The federal government offers a tax credit of up to a certain amount for individuals or businesses purchasing electric vehicles. This credit can significantly offset the cost of the vehicle and make it more affordable for potential owners.

State and Local Tax Exemptions or Rebates: Many states and local governments provide tax exemptions or rebates for eco-friendly car owners. These benefits can vary by location and may include exemption from sales tax, reduced vehicle registration fees, or rebates on charging equipment installation.

Deductions for Eco-Friendly Modifications or Upgrades: Some tax benefits extend beyond the initial purchase of the eco-friendly car. Owners may be eligible for tax deductions for eco-friendly modifications or upgrades made to their vehicles, such as installing solar panels or energy-efficient charging systems.

Case Studies or Examples

Real-world examples demonstrate the impact of tax incentives for eco-friendly cars. For instance, John, a small business owner, purchased an electric vehicle for his delivery service. With the federal tax credit and a state rebate, John was able to significantly reduce the upfront cost of the vehicle. This tax benefit motivated him to make the eco-friendly choice and contributed to the reduction of carbon emissions.

Current Trends or Developments

Recent trends in tax benefits for eco-friendly car owners include an expansion of federal incentives and the introduction of new state-level benefits. Governments are recognizing the importance of promoting eco-friendly transportation and actively working towards increasing the accessibility and affordability of environmentally friendly vehicles.

Challenges or Controversies

While tax benefits for eco-friendly car owners have numerous advantages, there are also challenges and controversies associated with them. Some argue that these benefits primarily benefit wealthier individuals who can afford to purchase eco-friendly cars. Additionally, there may be concerns about the long-term sustainability of government-funded incentives.

Future Outlook

The future implications of tax benefits for eco-friendly car owners are promising. As technology continues to advance, the cost of eco-friendly cars is expected to decrease, making them more accessible to a wider range of consumers. Governments may also introduce new tax policies and incentives to further encourage the adoption of these vehicles.

Conclusion

Tax benefits play a crucial role in promoting the adoption of eco-friendly cars. These incentives, ranging from federal tax credits to state and local exemptions, provide significant financial advantages for individuals and businesses. As the world continues to prioritize sustainability, tax benefits will likely continue to evolve and shape the future of eco-friendly transportation.

References

For further reading on tax benefits for eco-friendly car owners, the following resources are recommended:

“The Complete Guide to Electric Cars: 2019 Edition” – by Zachary Shahan

“Green Energy and Efficiency: An Economic Perspective” – by Leonardo Meeus

“Driving Green: An Introduction to Eco-Friendly Cars” – by Jennifer K. Bender